The Year of the Dragon is upon us, and with it, the auspicious energy of the Wood Dragon. This powerful combination of elements signifies growth, ambition, and a forward-thinking approach, perfectly aligning with the trends shaping the vibrant Asia Pacific (APAC) data center industry.

Markets such as Tokyo, Sydney, and Singapore all now offer over 500 MW of capacity each; Tokyo is double this size, and other regional markets growing rapidly. With key cloud providers announcing their plans to expand into markets like the Philippines, Thailand, and Vietnam, 2024 is fast becoming a critical year for data center infrastructure. Several key trends will shape the APAC data center landscape in 2024:

1. Hypergrowth of hyperscale data centers: Hyperscale data centers, characterized by their massive size and efficiency, are expected to experience significant growth in APAC. This is driven by the increasing demand for cloud computing services from businesses and governments across the region.

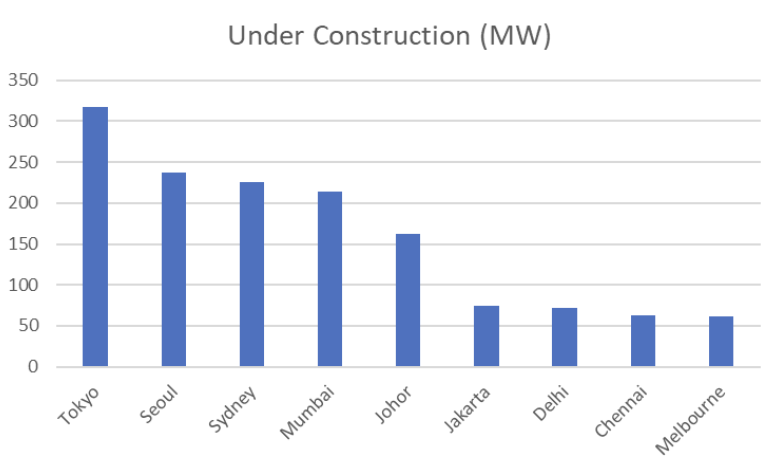

Several core markets across the greater APAC region have over 50 MW under construction, with growing areas such as Mumbai and Johor rapidly joining more established cities such as Tokyo, Seoul, and Sydney.

2. The Rise of AI:

-

- Data centers for AI: As more companies invest in AI technologies, the demand for computing power and resources will drive the demand for data center infrastructure. However, many data centers today must be equipped to handle the high rack densities and megawatts required to train large language models, and the eventual inference deployments once developed and live. To support rack densities as high as 30kVAs to 50kVAs, there will be clear requirements for access to stable renewable power and the development of advanced cooling systems such as direct-to-chip and immersion systems.

- Data centers powered by AI: As AI technology matures, data center operators in APAC are increasingly incorporating AI into their operations. AI optimizes energy efficiency, predicts, and prevents equipment failures, and automates routine tasks, leading to cost savings and operational efficiency.

3. Increased focus on Sustainability: APAC governments are implementing increasingly stringent environmental regulations, pushing data center operators to adopt sustainable practices. Renewable energy sources, energy-efficient technologies, and innovative cooling solutions will be adopted, reflecting the Dragon’s respect for the environment and commitment to a greener future.

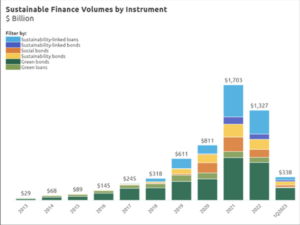

Green and sustainability-linked financing will become a powerful tool to raise capital for data center operators. According to the International Finance Corporate (IFC), issuance of sustainable finance instruments has more than doubled between 2020 and 2021 – crossing $6 trillion as of April 2023.

4. Data sovereignty and regulatory compliance will be top of mind for governments: As businesses continue to invest in the cloud – spending is projected to rise by 20.4% in 2024, according to Gartner – authorities are increasingly concerned about the regulatory concerns and the implications for national security. As highlighted in a recent IDC report, “The Impact of Digital Sovereignty in Asia/Pacific Governments,” regulatory authorities are looking into how digital sovereignty can be a pivotal factor influencing technology investment priorities, regulatory frameworks, partnerships, and skills in 2024. Recognizing the need for more control over data processing and management, governments are investing in digital sovereignty initiatives to safeguard their national interests.

5. Addressing the shortage of skilled talent: The data center industry is facing a critical skills shortage, particularly in the high-growth areas of AI, machine learning, and cybersecurity. Exacerbated by the rapid expansion of data centers, the Uptime Institute predicts a global workforce of nearly 2.3 million needed by 2025. Asia Pacific will account for most of the talent demand, due to the rapidly increasing market size and diverse regional needs. Attracting and retaining qualified data center professionals will become a major pain point for the industry, threatening to hinder growth and innovation. In the coming year, data center operators will invest in training programs and look to diversify the talent pool.

6. New markets will open for investment: Despite the Dragon’s territorial instinct, new markets will develop and attract investment. While traditional data center hubs such as Tokyo, Hong Kong, Singapore, and Sydney will continue to expand, the significance of peripheral city centers will increase due to constraints on power availability within urban areas. Markets such as Johor and Batam have gained interest thanks to their available land and power and proximity to the robust network options in Singapore. Jakarta has skyrocketed as Indonesia grows into a data center powerhouse reflective of the national population. Other secondary cities in developed markets, such as Osaka, will scale into global primary hubs of their own right, thanks to growing local demand and national requirements.

7. Facing soaring costs: Data center operators will need to channel the adaptability and resilience of the Wood Dragon as they approach their budgetary challenges. The Asia Pacific Data Centre Construction Cost Guide from Cushman & Wakefield highlights that construction costs have escalated to 8% across the region over the past year. Japan is one of the priciest markets for data center construction, with Singapore having the highest land costs. Despite the escalating costs, development persists unabated, driven by an unrelenting demand for AI, which promises to deliver phenomenal growth.

8. The edge will continue to evolve: While the nebulous concept of the “edge” has changed over time, the idea of bringing compute closer to the end user has been pushed to the background as the largest cloud players have focused on constructing ever-larger data centers far from urban centers for large-language model training. The question is, what comes thereafter, and do these AI-driven workloads begin to add to these platforms in 2024? Inference workloads (or AI once live) will require proximity to the end user for lower latency, though likely at a higher rack density than what is commonly seen today (30-50 kilowatts per rack versus 8-10 for most current cloud needs). This will lead to specialized developments in urban centers to accommodate, leading to a further shift across the industry.

By harnessing the powerful energies of the Wood Dragon and embracing the trends shaping the APAC data center landscape, businesses can ensure their success in the rapidly evolving digital landscape.

So, roar confidently APAC data center leaders, and let the Year of the Wood Dragon mark a new era of growth and success!

For more information on EdgeConneX Asia Pacific locations, please visit: https://www.edgeconnex.com/asia-pacific/